Highlights from the EO print edition, Issue Wrap No. 495, Nov 22

Immigration Asset Requirements for Chinese Double

Cover

~ With more and more wealthy Chinese trying to obtain Canadian citizenship, Canada has raised its requirements for immigrants. For example, their net assets have to be around 10.4 million yuan, double the previous required amount; and the amount immigrants are required to invest has also increased from around 2.6 million yuan to 5.2 million yuan.

~ Canada is not alone. Australia has also lifted the requirements for its business migration program. In fact, with a weak domestic economy and as more and more wealthy Chinese want to migrate, many countries are lifting their entrance requirements to ensure that they only allow China's elite a path to citizenship.

~ According to a report released by the Chinese Academy of Social Sciences, China has become the world's largest source of immigrants. From the beginning of China's reform and opening up, 35 million Chinese had immigrated to other countries by 2007, accounting for 18.3 percent of the total amount of international immigrants.

Original article: [Chinese]

China to Strengthen People's Livelihoods in Next Five-Year Plan

News, page 3

~ The Ministry of Commerce has completed drafting the 12th Five-Year Plan to promote domestic trade. Compared with the last five-year plan, the new plan is more focused on people's livelihoods.

~ While the 11th Five-Year Plan was focused on lifting commercial efficiency, the new plan puts more emphasis on improving people's living standards. For example, while the former set developing big companies as its priority, the latter emphasizes the promotion of communal business and family services.

~ Another focus of the new plan is to promote the use of cultural and educational products.

~ Additionally, China will continue to intensify investment in improving its rural market system.

Original article: [Chinese]

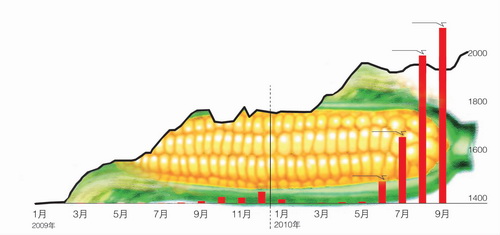

Some Corn with Your Soybeans? China's Corn Imports Surge

News, page 4

~ China's corn imports have increased by 56 times in the first seven months this year on the level of the same period last year to a total of 282,000 tons. Though this may not sound like much, this is the first time that China has imported corn in the past 4 years and the first time in 15 years that the country has imported corn on such a large scale.

~ This spike in imports has aroused the interest of American exporters and the American Agricultural Department who are hoping that China might become a huge market for the country's corn exports. Some have compared the Chinese demand for corn to that of soybeans, imports of which have also surged in China over recent years.

~ All of the corn that America exports to China is genetically modified.

~ There are various reasons why China's corn imports have exploded. While the National Development and Reform Commission, the Ministry of Agriculture and the State Administration of Grain have attributed the rise in imports to the price gap between foreign and domestic corn, many experts argue China's corn reserves have fallen dramatically due to increased demand and supply has also been reduced due to natural disasters.

Original article: [Chinese]

Battle over Southern Rare-Earth Mining Rights

News, page 6

~ The government has been combating illegal rare-earth metal ore mining for half a year, which has boosted prices, and has increased the desire of local governments for more mine exploitation rights.

~ Aside from local governments, national enterprises such as China Minmetals Corp and Chinalco have also entered the fray.

~ Local governments will attend a meeting in December during which they will decide on rare earth mineral exploration access requirements, a supervision plan for the extraction and transport of rare earth minerals and a plan for the formation of a mining enterprise union.

~ At present, the redistribution of rare-earth mining rights is still being debated; there is still no set timetable according to an official from the Ministry of Land and Resources.

Original article: [Chinese]

Who's Responsible for the Shanghai Fire?

Who's Responsible for the Shanghai Fire?

Nation, page 9

~ The deadly fire that engulfed a building in Shanghai's Jing'an District last week claimed 58 lives and injured many more. Though both the central and local governments have said they'll conduct a thorough investigation, it's still unclear who should be held responsible for the tragedy.

~ EO reporters have learned that the construction company, Shanghai Jiayi Construction Company (hereinafter refered to as Jiayi) and its parent company, Shanghai Jing'an District Construction Company, have both been blacklisted by the Shanghai government in the past for failing to meet construction safety requirements.

~ However, with such a bad record and with a registered capital of only five million yuan, Jiayi was still able to win over 40 government projects, including an energy-saving project that was being carried out on the building that caught fire last Monday. All of these projects were awarded by the Jing'an government.

Original article: [Chinese] - Also see this week's editorial - Who\'s Accountable for the Fire that Should Never Have Happened?

China Banking Regulatory Commission's New Approach to Addressing Lenders Exposure to Local Financing Platforms

Market, page 19

~ Commercial banks and the China Banking Regulatory Commission (CBRC) have been trying to work out how to deal with the risks posed by banks exposure to local government financing platforms for the past two years. The situation has now entered a critical juncture, with sources at some commercial banks informing the EO that the CBRC is finally prepared to unveil a new set of regulations aimed at dealing with the problem.

~ An unanmed individual working in the office responsible for issuing loans to local government-backed financing platforms at one of China's commercial banks, told the EO that the CBRC had already made up its mind on a new set of regulations.

~ The CBRC have already asked commercial banks to divide their outstanding loans into four categories according to the cash flow coverage ratios of the financing platforms. Cash flow coverage ratios are a measure of an enterprises ability to meet its debt obligations based on its operating cash flow. The four categories refer to financing platforms whose cash flow can fully cover their debt obligations, those whose cash flow can basically cover their debt obligations, those that can cover half of their obligations and finally, a fourth category for those finacing platforms that cannot cover any of their debt obligations.

~ The banks have also been required to convert the loans made to most of the local financing platforms into normal company loans if possible.

~ For those loans that fall into the fourth category, a time-table to repay the loan will be drawn up and new lending to such financing platforms will be strictly prohibited.

Original article: [Chinese]

An Investigation into China's "Most Expensive" Stock - Walvax Biotech

Market, page 17

~ On November 12, Walvax Biotech listed on ChiNext, China's Shenzhen-based growth enterprise board. The price of the stock was 95 yuan at the time of issue, which equated to an earning to price ratio of more than 133.

~ The listing of the company created 10 billionaires and 9 multimillionaires, with most of the winners being former employees of the Kunming Institute of Biology, which operates under the auspices of a state-owned enterprise.

~ Many of the shareholders in Walvax Biotech were able to take the research and technology that they had developed while working at the Kunming Institute of Biology and then use their knowlege to develop products at their new company.

~ One expert familiar with this situation described it as a brain drain that had caused the loss of national capital. "They only made a few small changes, but were still able to patent their technology. But strictly speaking, it certainly involves the infringement of intellectual property rights."

Original article: [Chinese]

Opening of Low-altitude Airspace to Benefit Aviation Industry

Corporation , page 28

~ Military restrictions on low-altitude airspace have long hindered the growth of China's airline industry.

~ On November 14, the State Council's Central Military Committee (CMC) released a report titled "Intensifying the Reform of Opinions on China's Low-Altitude Airspace Management."

~ The CMC report proposes that over the coming 5 to 10 years, following deepening reforms within the low-altitude airspace management system, scientific theories and methods will be established, official regulations will be implemented, and support will be provided to management operations and service systems. The report is still being drafted and revised.

~ For a long time, China has lagged behind other large economies in its development of general aviation.

~ In 2009, the value of China's general aviation industry was roughly 1.8 billion yuan; the US industry was worth about 150 billion US dollars.

~During the last two years, members of the Chinese airline industry have sent letters to the State Council requesting the opening of airspace below 3,000 meters. These industry members have also been in touch with China's national air traffic control and have hired professional institutions to conduct research on the opening of low-altitude airspace and its effects on the development of the general aviation industry.

~ Rapid expansion in the general aviation industry has been apparent both upstream and downstream, with parts suppliers, pilot schools, and other relevant businesses also reaping the benefits.

Original article: [Chinese]

A Holiday from Wall Street - GM and the Chinese Automobile Industry's 500 days

Automobile , page 33

~ 536 days seems a little bit too short for a global industrial behemoth to go from bankruptcy to reissuing its Initial Public Offering (IPO); yet, in 2010 General Motors (GM) has defied the odds.

~ On November 18, after a 16-month absence from Wall Street, GM issued the largest IPO in American history. The company listed with shares debuting at 33 US dollars, which amounts to 23.1 billion US dollars worth of shares in total.

- However, in China, the focus of this news has not been on GM, but on Shanghai Automotive Industry Corp. (SAIC), which spent 500 million US dollars to acquire a 1 percent stake in the American company.

~ One of the first decisions made after the establishment of the post-bankruptcy GM was very relevant to SAIC: the company decided to close down its regional offices and instead set up a Shanghai headquarters responsible for all business outside of North America.

~ SAIC's purchase of 1 percent stake in GM is only one facet of the cooperation between the two firms. In August 2010, both companies signed a joint venture contract to develop a new generation of energy-saving hybrid powertrain technology. Under the agreement, SAIC and GM will share the intellectual property rights of the new engine and transmission designs.

~ SAIC was not the only Chinese firm to benefit from GM's increased presence in China. On August 30, 2009, FAW Group signed a joint venture agreement with GM to produce light commercial vehicles; while in December 2009, Beijing Automotive Works announced the purchase of the Saab 9-5 and the Saab 9-3 technology platforms from GM.

~ However, from the perspective of investors, whether Chinese auto companies seized opportunities during the 500 days of GM's break from Wall Street or missed them, still remains to be seen.

~ Some analysts feel that SAIC could have adopted a much bolder strategy, so as to take better advantage of GM's situation.

~ As State Information Center director Xu Changming stated, "regardless of success or failure [SAIC] has inspired the Chinese auto industry."

Original article: [Chinese]

Chinese Electric Cars: Giants or Dwarfs?

Automobile , page 36

~ For many years, China's government departments and corporations have professed belief that China's car manufacturers can greatly capitalize on the expected boom in electric car manufacturing.

~ However, at the recent 25th World Conference on Electric Vehicles held in Shenzhen, many expressed doubt in China's technological ability to be successful in producing electric cars.

~ Secretary-general of the China Association of Automobile Manufacturers, Dong Yang, explained that Chinese manufactures are not at the same starting line as international conglomerates when it comes to the race to develop electric cars. He added that the sooner Chinese companies commit to the electric automobile industry, the sooner they will develop the technology to be able to compete with Japanese and American firms. Dong Yang's assessment was backed by a majority of experts at the conference.

~ BYD chairman Wang Chuanfu refuted this claim, saying that technological deficiencies are not characteristic of the entire Chinese automobile industry. Instead, he told reporters that BYD is actually an international leader in electric automobile technology. For months though, industry analysts have been calling into question BYD's technological capabilities.

~ The gap between Mr. Wang's claim and growing skepticism among analysts may be attributed to BYD's stringent secrecy regarding its battery technology.

~ Nearly everyone is concerned that by repeating the policies and mistakes that caused it to lag behind in the traditional car industry, China will not only fail to become a "giant" in the electric car industry, but will actually become a "dwarf."

Original article: [Chinese]