The Economic Observer ran a series of five articles this autumn that examined how China's tax and fiscal system operates, focusing on how central and local authorities share government revenue. To read the other articles in the special feature, click here.

Issue No. 540

Oct 17, 2011

News, page 3

Original article: [Chinese]

Local governments are taking steps to boost income by the end of 2011: tax bureaus in Nanjing and Yandu (鹽都) in Jiangsu province have launched a special "100 days" tax collection project, while Guangdong plans to introduce a new levy on enterprises and Zhejiang province is busy preparing to issue provincial bonds.

As the real estate sector weakens, local governments have seen a decline in the amount of revenue it collects from taxes and fees levied on the industry. Land transfer income has fallen sharply in Shanghai, Beijing and Guangzhou, while Zhejiang has also lost tax revenue from businesses whose owners "ran away."

Meanwhile, local governments have been laden with rising costs as demands from large-scale investment projects mount and spending on education, medicine, public housing and agriculture also increases.

As a result, taxes are being modified and supplemented. A new-look resource tax was introduced on Nov. 1, which will generate extra tax income of 60 billion yuan a year, while the revival of various idle taxes will raise another 500 billion yuan annually.

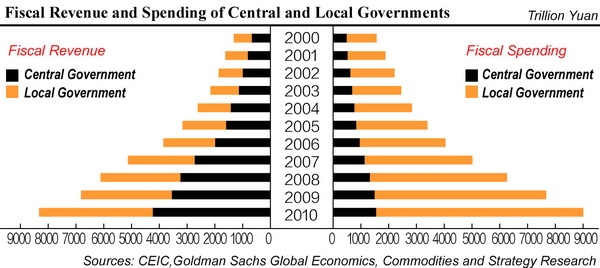

However compared with local governments, the fiscal position of the central government is relatively stable. The major tax reforms enacted in 1994 guaranteed that the central government would receive a stable share of tax revenues, and with no sign of any major changes to that arrangement, local governments have been forced to introduce their own measures.